Klarna and Xero Leading Fintech Expansion

Hi there! We’ve seen some previous fintech startups in the payment field making bold moves to expand. There’s a lot we can learn from them.

If you are in the process of expanding your own company, one of the biggest issues you may run into is the inability to find skilled development talent fast enough to meet shifting deadlines.

We’ve helped companies by augmenting their staff and providing the talent that they need within a couple of days. If you want to learn more about how we ensured a fintech firm’s development needs were met, check out this case study.

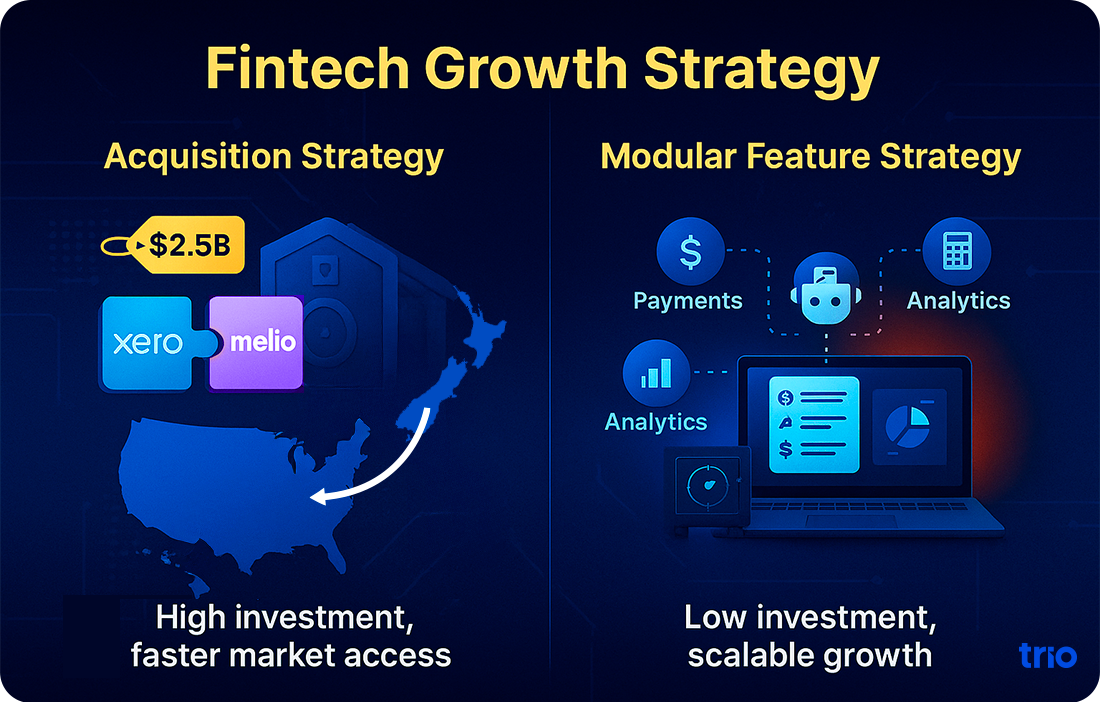

The New Zealand accounting software company Xero has just made moves to buy the payment provider Melio for $2.5 billion!

The New York-based fintech will likely play a major role in allowing Xero to enter U.S. markets.

We’ve also seen time and time again that providing more than one service to customers, like accounting and payments in this case, increases your overall value and the likelihood of users keeping your product.

Instead of creating a bunch of these features themselves, many fintech companies outsource them. If you don’t have the funds to purchase a company like Melio, build modular features that integrate with the rest of their app.

We have helped many clients with this, and added to their teams if they want to build the features in-house.

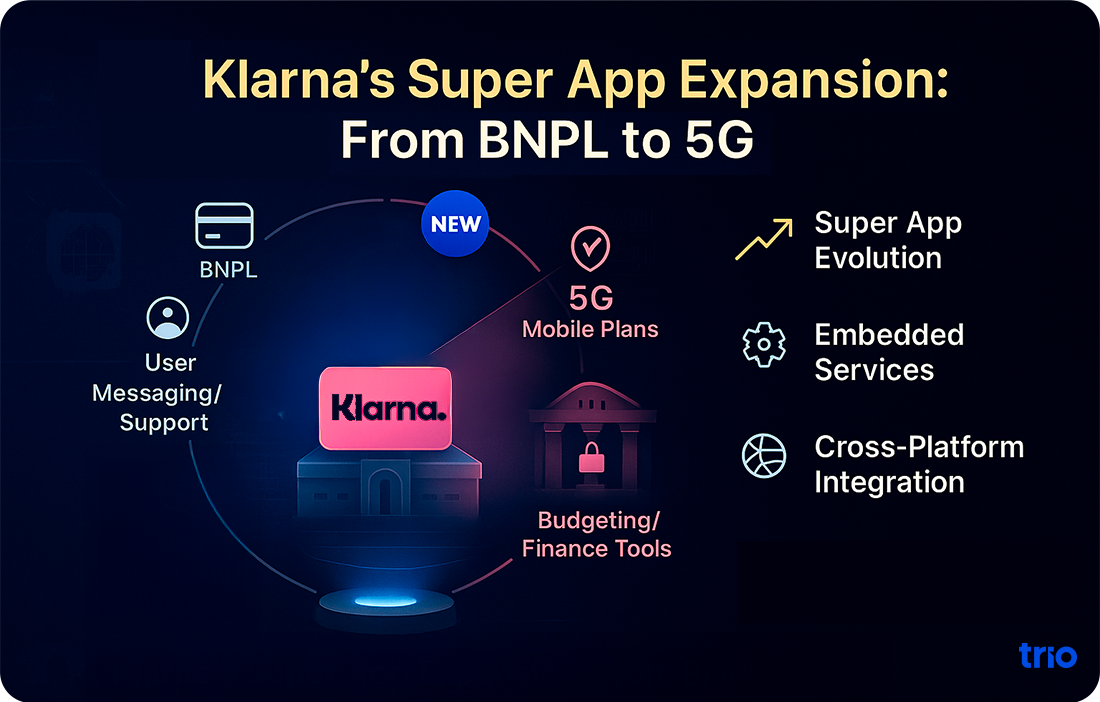

Klarna is well-known for its BNPL (buy now, pay later) options. However, the financial services provider is now expanding its offerings to mobile plans.

By making use of AT&T’s network, they are able to provide affordable mobile services, giving them a bigger impact on the overall customer journey.

Yet again, this is part of a broader shift to more comprehensive, super apps that take care of not only finances but other aspects of a user’s life.

Embedded services and cross-functional platforms are definitely booming trends at the moment to facilitate this shift in user expectations. Getting experts on your team can help you analyze potential opportunities for your own app.

Other Stories Worth Noting

The fintech industry has been changing quickly recently. Much has happened in the last few weeks:

Revolut has appointed a CEO for Western Europe. We discussed this expansion a few weeks ago, and are happy to see Revolut doubling down in preparation for a banking license of its own.

The U.S. Senate has voted to pass the GENIUS Act, which is going to directly affect the regulation of some cryptocurrencies. Digital assets like stablecoins may become more normalized with this increased regulation.

In Malawi, PayChangu and Centenary Bank have partnered to provide real-time payments from any bank in the country. We expect this will be particularly empowering to e-commerce merchants who deal with large deposits.

Final Thoughts

Fintech is moving faster and becoming more inclusive. This is great for users, but it does increase the barrier to entry for startups with limited funds. Making use of outsourcing and staff augmentation is a great way to cut costs.

If you have found this newsletter insightful, share it with someone else who may benefit from the content. Anything to add, or something you think we’ve missed? Hit reply to let us know. We love to hear from you!

Until next time - keep expanding!

Upcoming Events

Trio will be at Fintech DevCon to connect with others in financial services app development. Want to meet up? Let’s connect to schedule a coffee!

Related Articles

How to Build and Manage Outsourced Teams