Stablecoins Becoming the New Normal?

Hi there! Stablecoins and crypto have been big news this week. Will they become part of our core financial infrastructure? It’s too soon to tell, but we’re definitely keeping an eye on it.

From the GENIUS Act in the United States to Singapore-based Ant International considering a stablecoin licence, the world of decentralized finance is shifting quickly. Falling behind could be incredibly detrimental to anyone in fintech.

If you want to learn more about cryptocurrency in fintech, make sure to check out this article on how traditional banking has been transformed.

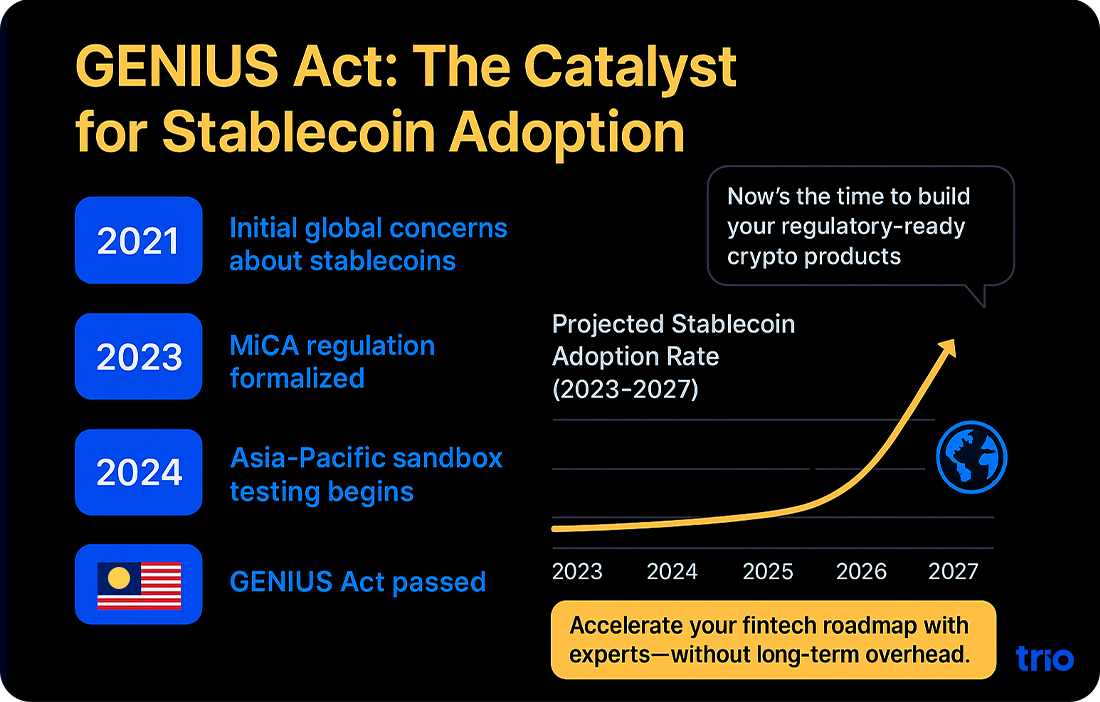

The GENIUS Act has officially been passed. Some major banks have been considering dipping their toes into stablecoins for some time, and the Act has appropriately introduced formal regulations regarding the digital currency.

This is consistent with global trends that promote the secure and legal use of these kinds of assets.

We suspect that the introduction of these regulations will accelerate the adoption of these new technologies worldwide.

If you haven’t prepared, you’d better get started.

Using a staff augmentation firm, such as Trio, can help you assemble the right team members to rapidly accelerate your development, without the need to worry about long-term commitments and associated costs.

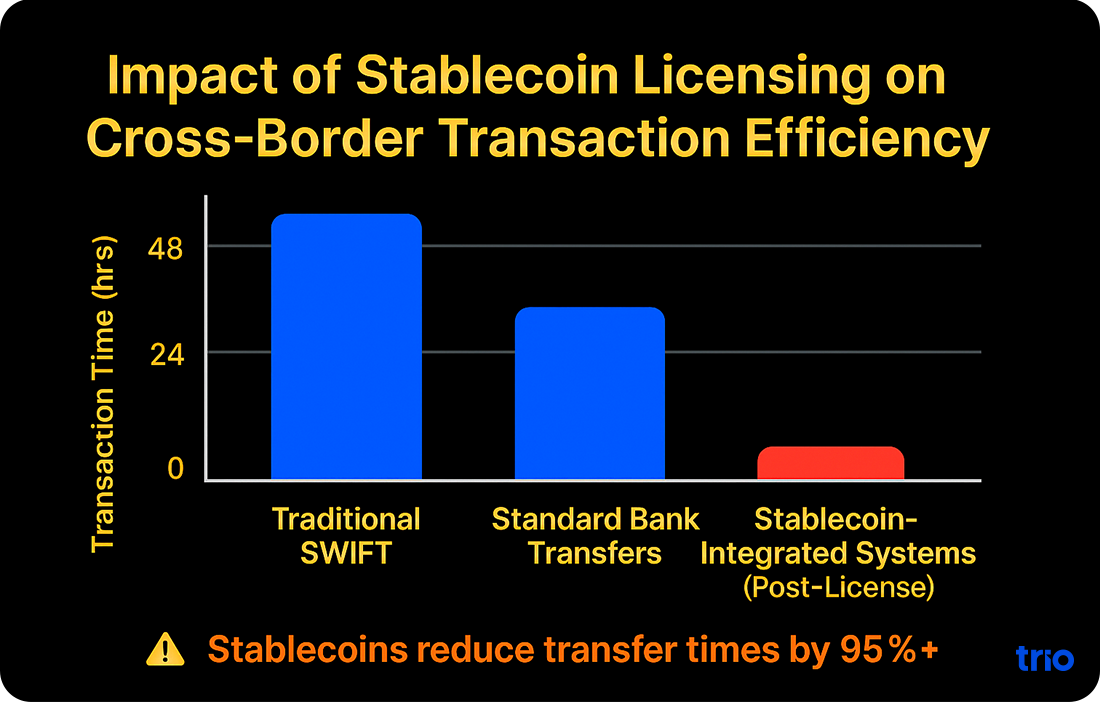

Singapore-based Ant Interation is considering applying for stablecoin licenses in multiple areas. If they are successful, their cross-border payment efficiency is going to skyrocket!

While nothing has been set in stone yet, we see no reason to think this will not happen. Many companies will likely follow suit.

Since these cross-border finance systems will be built on legacy systems, it is essential to ensure that you are prepared for stablecoin integration and regulations now.

Failing to set your systems up for successful scaling and new features like these going forward only means you build up a massive tech debt, placing your developers under more pressure later.

Hiring fintech experts to consult on areas where you may need to update your software is a valuable addition to a long-term scaling and risk management strategy.

Other Stories Worth Noting

There are a couple of other things happening in the fintech industry you should know about:

Block, or the PayTech company you might know as Square, has just been added to the S&P 500! Not only has this been great for the company’s stock, but it has also demonstrated that large firms believe this kind of technology is here to stay.

India is getting Nxtbanking, a 100% AI-powered fintech platform set to empower companies in the finance sector while providing everything they need in terms of compliance and security. We’re excited to see what financial services the platform can provide successfully.

Final Thoughts

Stablecoins are becoming more commonplace. Ensure that you are prepared to adjust as major global players begin experimenting, and regulators respond accordingly.

If you’ve found this edition of our newsletter informative, share it with someone who may benefit. Do you have any insights to add or something you think we’ve missed? Let us know.

Until next time - stay compliant!

Upcoming Events

Trio will be at Fintech DevCon to connect with others in financial services app development. Want to meet up? Let’s connect to schedule a coffee!

Related Articles

Fintech App Development in 2025 | Step-by-Step Guide

Top 10 Mobile Fintech Solutions Transforming Banking and Payment