The Fintech IPO Wave Begins!

Hi there! Over the last two weeks, public markets have been filled with fintech-related news, from IPO plans to those who are surprisingly delaying their debuts despite massive valuations.

As a fintech leader, there is a lot to learn from the decisions made by these companies. Specifically, we’ve been able to examine the many factors outside of valuations that play a role in success.

You need to have scalable infrastructures in place so that you can continue to deliver quality services under pressure! To ensure you are setting yourself up for growth, check out this article on preparing for hyper-growth.

Klarna, one of the biggest names in fintech, has started its market debut preparations. The company seems to be aiming for a listing value of as much as $14 billion!

The company’s growth in recent years has shown us that many people are seeing value in fintech companies, even when their models were once deemed to be quite risky.

But, we would be remiss if we did not mention that the company has been able to maintain a stellar reputation, with an incredibly scalable infrastructure that has kept up with increased market demand.

If your user base increased, would you be able to deal with the traffic spike? Any downtime affects perceptions of your reliability. Our fintech experts can help you ensure you are prepared.

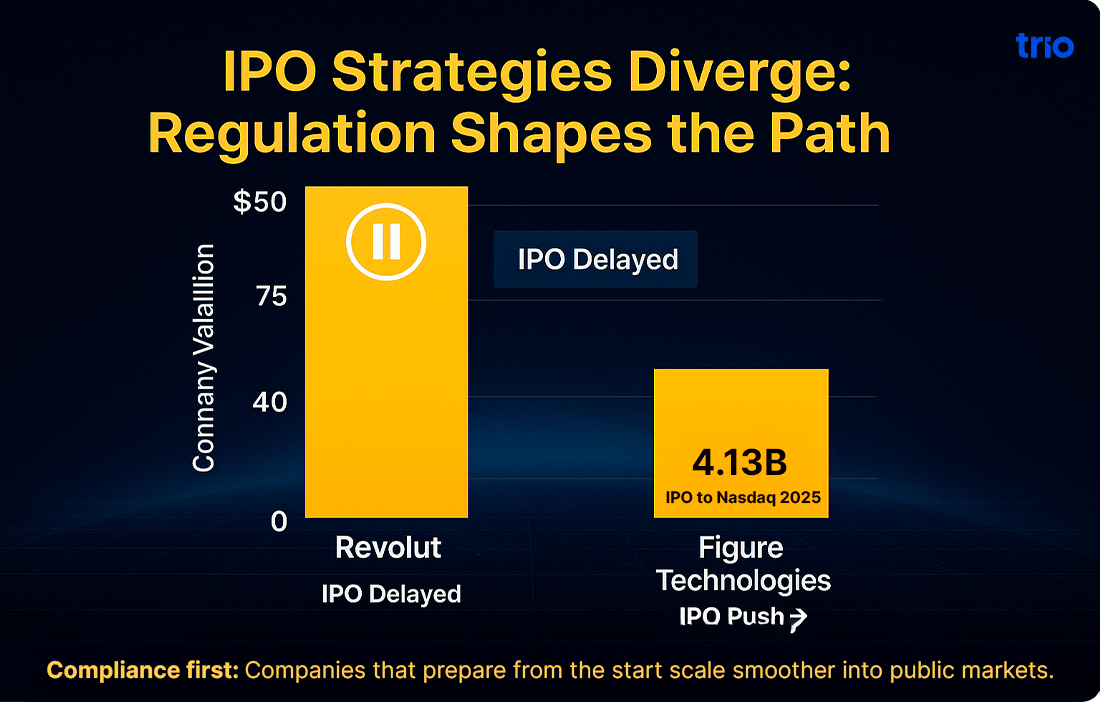

Revolut, the neobank that has been widely successful this year so far, has been able to increase its valuation to $75 billion! But, despite the positive outlook, it seems to be holding off on its IPO.

On the other hand, Figure Technologies, a blockchain lender, is looking at a valuation of $4.13 billion as it approaches its first public offering. Its push to Nasdaq follows a merger with a blockchain marketplace earlier this year.

These are very different strategies, and a significant contributor might be regulatory difficulties. The UK has made Revolut’s growth difficult. Regional governance differs significantly, so you must be aware of your region’s laws.

Entering public markets means additional scrutiny. While there is no indication that Revolut is anything but compliant, the same cannot be said for all companies.

Ensure that you integrate compliance into your product from the outset. It can be costly to do so retrospectively.

Other Stories Worth Noting

Some other things are happening which you might want to keep an eye on:

N26 Appoints Supervisory Board Chair: The German neobanking fintech has chosen ex-central banker Andreas Dombret. The move is likely to have a positive impact on their governance, a wise decision in the compliance-focused industry.

PayNearby Plans Public Debut: The Indian banking and payment fintech hopes to go public in the 2026-2027 financial year. A massive contributor to their success has been their work in underserved areas, partnering with retailers to offer cash withdrawals, bill payments, and more.

Final Thoughts

Scaling your fintech infrastructure for hyper-growth is a non-negotiable. You want to be able to push ahead and eventually handle the rapid scaling that comes with a public debut. Our fintech specialists can ensure that you are secure, compliant, and scalable in the most cost-effective way possible.

If you have found this edition informative, share it with someone who can benefit from the information. Anything to add, or something you think we’ve missed? Hit reply! We love to hear from you.

Until next time - prepare for hyper-growth!